Under UK law, landlords have a duty of care to their tenants, which means they have a responsibility to take reasonable steps to keep their property in safe working order. But if they breach this duty and a tenant is injured in the property, they could be liable and required to pay hefty fines.

In addition to the cost of a claim, a negligent landlord could find themselves dealing with legal proceedings, as well as enforcement actions from local authorities if they’re found to be failing to comply with housing legislation. In this guide, we’ll take a look at what this means in practice and how landlords can protect their tenants, and themselves, from the consequences of an accident, from comprehensive insurance to maintenance.

[Image source: Deposit photos]

Common hazards in a rental property

A personal injury claim can come from various hazards so recognising the potential threats can help landlords take appropriate action to mitigate these risks before someone gets hurt. If a tenant has an accident because of their own possessions, or because of a guest or other tenant, the landlord shouldn’t be liable. However, the following situations could mean they’re responsible.

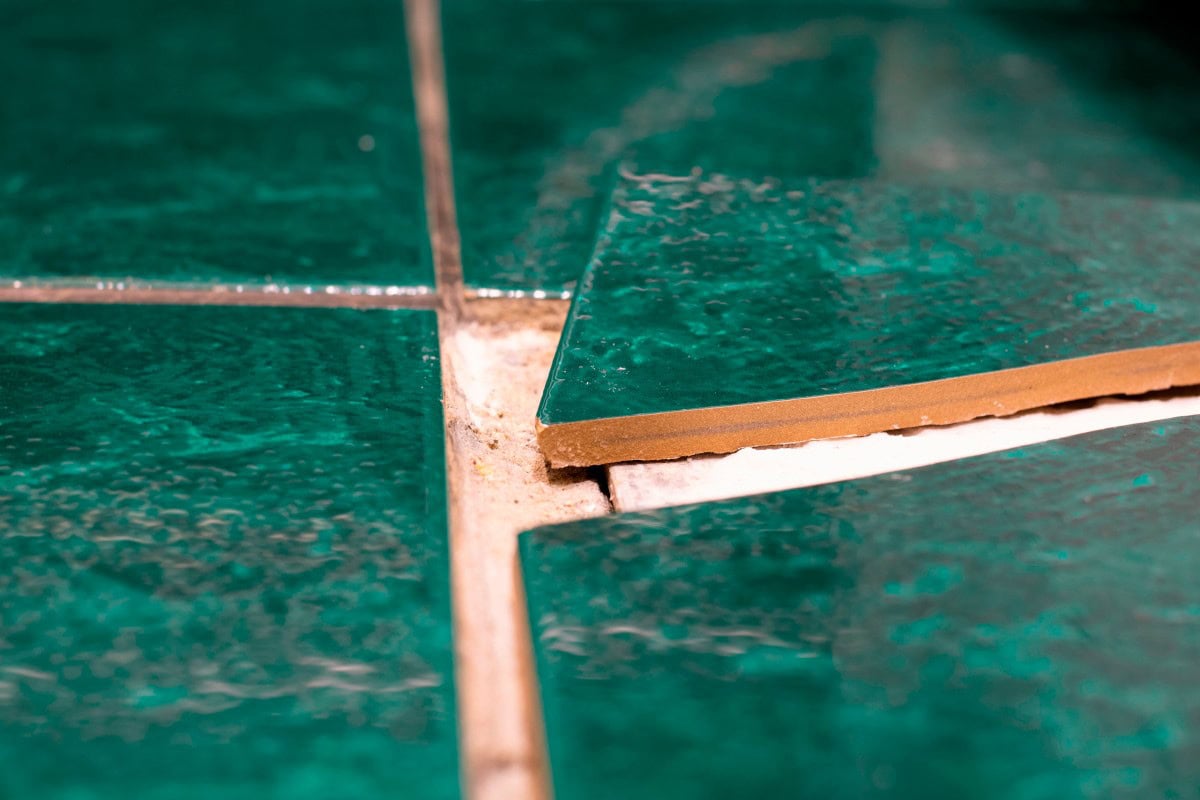

Slips and falls

A loose floorboard, an uneven staircase, or a badly installed carpet could all pose a trip hazard. Even poor lighting or a broken paving slab could be a risk and deemed unsafe.

Air quality

Indoor air quality is of huge importance in a rental property. From poor ventilation and damp posing the threat of mould, to carbon monoxide poisoning caused by faulty boilers or gas appliances, landlords could find themselves liable if they don’t maintain the property and cause or exacerbate respiratory problems.

To mitigate the risk, all gas appliances need to be checked by a ‘gas safe’ engineer once every 12 months, and under Scotland’s regulations for fire safety, all rental properties need to have interlinked alarm systems that are placed in the living room, every hallway and landing, together with a heat alarm in the kitchen.

Burns

A defective hot water system can post the risk of a scald or burn, caused by excessively hot water coming out of the taps. Just as with the gas appliances, the plumbing should be checked annually by a qualified plumber to make sure there aren’t any faults.

A ‘reasonable timeframe’ can vary depending on the circumstances. If the risk of an accident is low, or the repairs can take time to resolve, a delay in getting the problem fixed might be considered reasonable. But if the risk is high, it’s vital that landlords act quickly and take whatever steps are necessary to protect their tenants.

What steps should landlords take?

Adhere to the Repairing Standard

A key component of the Housing (Scotland) Act 2006 is the Repairing Standard – this sets out the minimum physical standards that landlords should maintain within their rental properties. Under this act, any rental property in Scotland should be wind and watertight, structurally sound, and all gas and electrical supplies should be safe.

Be proactive

Landlords could be liable for any injuries that occur on the property, if the risks were known about beforehand but they didn’t make necessary repairs. Ignorance about a defect can’t be used as a defence, particularly if regular inspections would have caught the issue before the accident.

As a result, regular inspections are critical to prevent these problems. Landlords need to provide notice before they can access a rental property that’s occupied, so these need to be scheduled well in advance so that tenants are aware.

Create comprehensive reporting processes

It’s also worth making sure that tenants know the correct processes for informing landlords of any issues they come across – this should be in writing so there’s an email trail to look back on. This gives landlords the time to have the fault fixed and keep a positive landlord-tenant relationship in place by proving that they’re proactive.

A detailed report with clear photographs that show the condition of the property is key before tenants move in. It protects all parties by ensuring that there’s evidence of the state of the building before any wear and tear can occur.

Have insurance in place

The costs of an injury claim can be extensive, so insurance is essential to protect yourself. Landlords’ insurance will protect you against the cost of fighting a personal injury claim and any compensation the tenant might be owed if their claim is successful. Insurance isn’t a substitute for taking care of any repairs or maintenance, but it does protect you against expensive legal situations.

Landlords have a legal and ethical responsibility to ensure their rental properties are safe for tenants, and failing to address potential hazards could lead to serious consequences, including personal injury claims and financial liabilities. In addition to conducting regular inspections and implementing clear reporting processes, buy-to-let investors need to ensure they’re maintaining comprehensive insurance and mitigating risks by keeping the property and any included appliances in full working order. Proactive property management protects tenants from harm, but it also safeguards landlords from costly legal disputes.