Hard to believe perhaps but it’s now 10 years since Citylets published its first quarterly report ‘Trends In Residential Lettings’. It has been very satisfying to see it evolve over the years to arrive at its current format. And of course for it to be accepted by the Lettings Industry as the de facto source of market trends in Scotland for new tenancies in the PRS.

We enjoy producing our quarterly reports and look forward to what the next few years will bring at a time where the PRS holds unprecedented societal and political significance in Scotland.

The latest Citylets Report to Q4 2016 is now available.

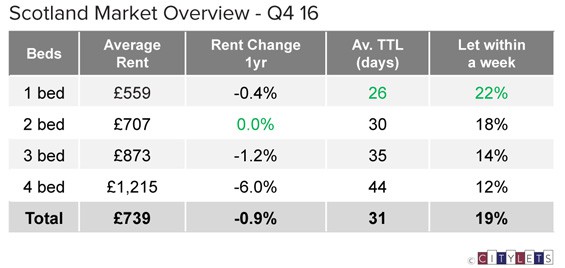

Scotland

Average rents in the Scottish PRS at the national level recorded an uncharacteristic dip in Q4 2016, down 0.9% on the year to stand at £739 per month on average. Downward pressure from Aberdeen over the last 2 years is usually countered by around 6% growth in Edinburgh and, more recently, the central belt including West Lothian and Glasgow resulting in overall positive growth.

However a slight cooling in the rate of growth in some markets of the central belt pushed annual national growth into the red in Q4 2016. The main 1 & 2 bed markets in Edinburgh continued their steep rise at circa 6% and it will be interesting to see if this rate of annual rise will be maintained much longer.

The pace of the national market remains virtually unchanged over the last year with 61% of all properties let within a month and with an average TTL of 31 days.

Commenting on the Scottish Market, Fiona Hindshaw of Clyde Property said:

“Q4 marks the end of a busy year for Scotland’s property and letting market with legislative changes, the imposition of the 3% second property LBTT and of course Brexit all hitting the headlines. That being said, the general consensus across the board in Scotland is that the lettings market demonstrated continued strength and growth when compared to the same period in 2015 and we expect to see this growth continue in 2017.”

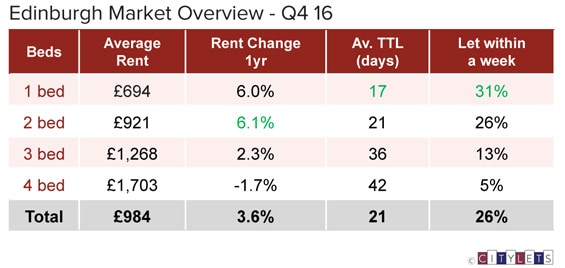

Edinburgh

Average rents in Edinburgh stand at £984 per month, up 3.6% Year on Year (YOY). Less than the circa 6% recorded in recent quarters, the larger 3 and 4 bed properties pulled the City average down with 1 & 2 bed rentals continuing their steep rise of 6% and 6.1% respectively stretching tenants’ budgets ever further.

“Again in Q4 of 2016 there has been high demand for all levels of rental properties across the spectrum and with the time to let and average rent remaining both low and strong respectively. The market continues to strengthen with demand exceeding supply, a problem which the government must look to address in the early part of 2017.” (Jamie Kerr of Ben Property)

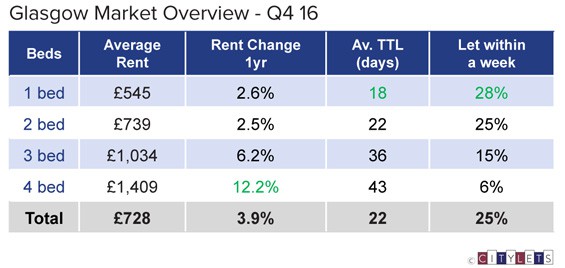

Glasgow

The Glasgow rental market continues to rise, up 3.9% YOY to stand at £728 on average. As with Edinburgh, this is down from the high growth recorded last quarter (7.2%) but unlike the capital it was the larger 3 & 4 bed properties outperforming the smaller rental homes. The percentage of properties let within a month rose from 70% at Q3 to 72% with average TTLs for the city as a whole remaining fast at 22 days. 28 % of 1 bed properties and 25% of 2 bed properties let within a week.

“2016 has been an exceptionally busy year in the PRS with many agents working tirelessly to ensure their ducks are in a row with respect to the myriad of compliance issues. As such, we’ve seen many landlords now in the situation where they’ve had enough of self-management and are seeing them turn to letting agents to take on their workload and ensuring their portfolios are fully compliant with all current legislation. Looking forward to 2017 we anticipate that the housing stock will be in a much better condition as a result.” (Colin Macmillan of Glasgow Property Letting)

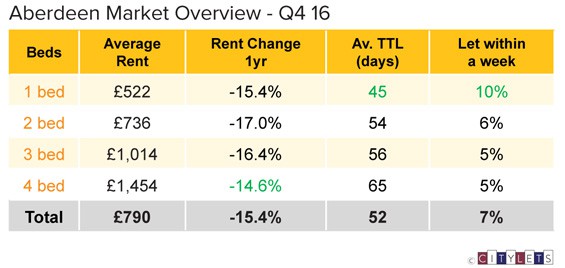

Aberdeen

The easing in the annualized rate of decline observed last quarter has held steady in Q4 with average rents in the city down 15.4% to stand at £790 per month. Average TTLs are now 52 days, a moderate 6 days up on last year and further indication that the Aberdeen rental market is finding its new level.

“We had a busy final quarter of 2016 with more new properties coming on the market and increased lets which is encouraging and hopefully a sign of things to come in 2017. It is my opinion that whilst the Aberdeen market has passed the worst, I am anticipating further minor falls in average rentals during the first half of 2017 before we start to see the beginning of a slow recovery. To paraphrase Winston Churchill I would suggest it is not the beginning of the end, but it is perhaps the end of the beginning.” (Adrian Sangster of Aberdein Considine)

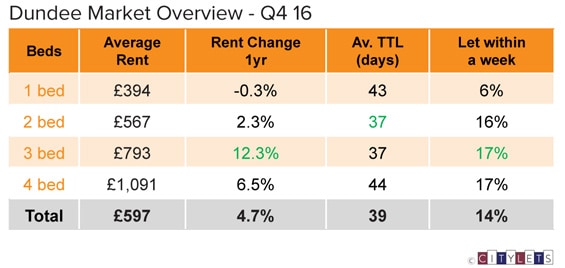

Dundee average rents posted a 4.7% annual rise to stand just shy of £600 at £597 per month in a quickening market where average TTLs fell by 4 days to 39 and with 49% of properties now letting within a month.

“Lickley Proctor Lettings have experienced a great deal of activity in the last quarter. There has been a fluctuation in viewings recently but this tends to be the case at the tail end of the year. Rental levels, however, are being maintained which is good news for prospective landlords looking to invest in Dundee.” (Robert Murray of Lickley Proctor Lettings)

The full Citylets Quarterly Report on Scotland’s rental prices can be found at https://www.citylets.co.uk/research/reports/pdf/Citylets-Quarterly-Report-Q4-16.pdf?ref=bl

The Citylets Quarterly Report is widely regarded as the most authoritative barometer of the Scottish PRS. For enquiries, please contact us.