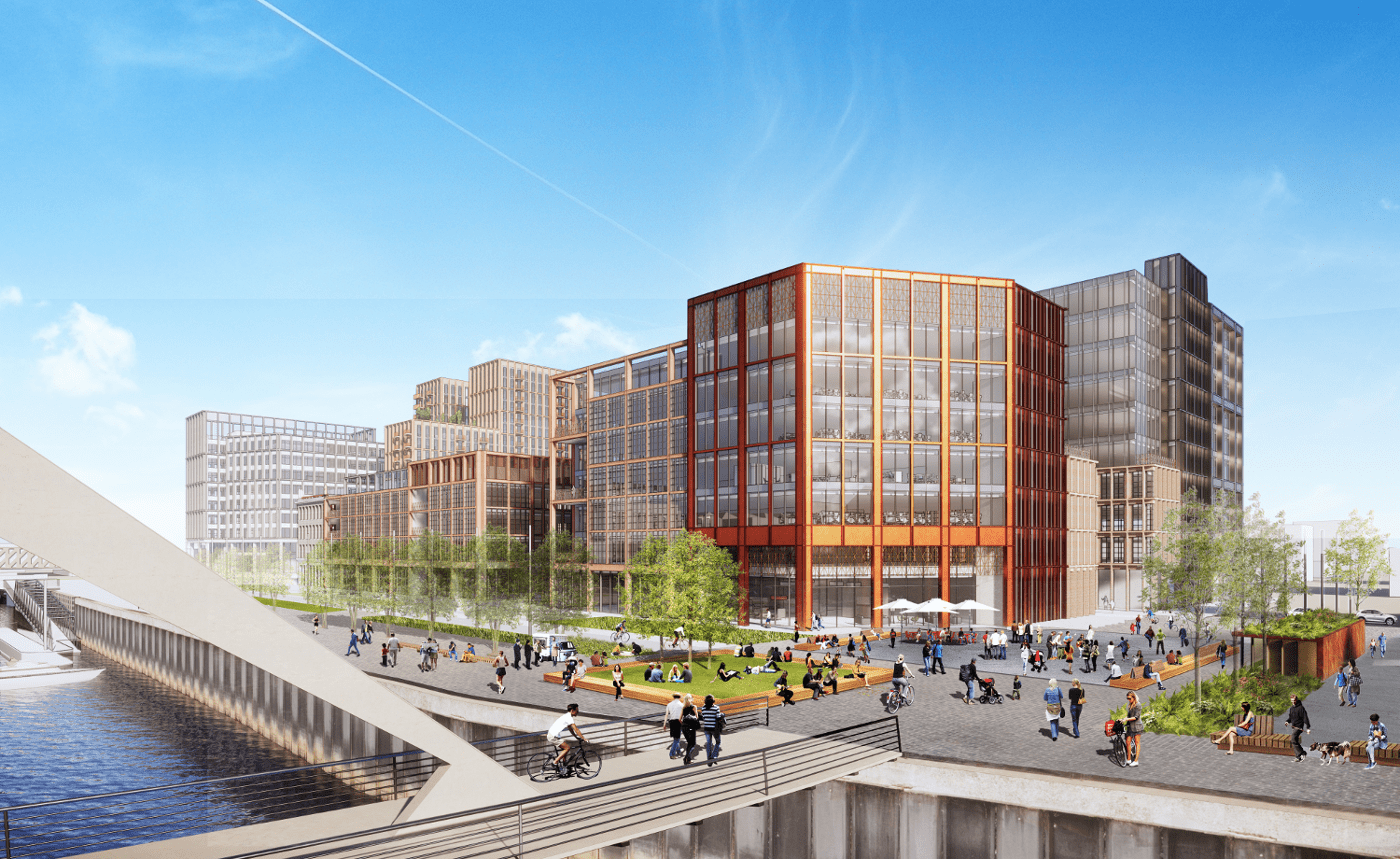

Major Build to Rent provider, Legal & General, are to deliver their first purpose built apartments for the Scottish Private Rented Sector. They will provide funds for Drum Property Group to construct two 18 storey towers, consisting of 324 flats within Glasgow’s new Buchanan Wharf waterside regeneration area, which will also include the new Northern European hub of Barclays Bank.

Only walking distance from Glasgow Central Station and the International Financial Services District, linked by the Tradeston Bridge, the Buchanan Wharf apartments will be overlooking the River Clyde. Their residents will benefit from a 4,250 sq ft communal roof terrace, a gym, a dining space and lounge, as well as a games room.

Key target for regeneration

Paul Miller, MD Principal Investing at Legal & General Capital, said: “We are delighted to be making our first Build to Rent investment in Scotland as part of our ambition to tackle the housing shortage all across the UK.”

He continued: “Scotland, and Glasgow in particular, has been a key target for Legal & General as part of our Future Cities initiative. We are excited to be bringing a long term sustainable rental scheme to the area to meet the demands of this vibrant and fast-growing city.”

Severe lack of homes in Glasgow

Over the last 10 years, Glasgow has suffered from particularly low levels of residential developments compared with other major cities. According to Glasgow City Council, in 2017 only 517 homes were built, falling significantly short of the 2,500 new residential units needed per annum.

“Glasgow has seen very low levels of residential development over the last decade. This acute supply and demand imbalance has made it an important target for us, demonstrating our commitment to quality asset selection, with sites cherry-picked by assessing needs-based demand to provide long-term, stabilised cashflows for investors” – said Dan Batterton, Head of Build to Rent at LGIM Real Assets, who raised additional pension fund capital to finalise the site’s purchase by co-investors Legal & General and PGGM.

Mr Batterton added: “With Glasgow predicted to continue to see notable population growth, this latest acquisition is another great example of Legal & General investing in an area with significant urban regeneration potential and providing large scale sustainable rental schemes which will have a positive long term socioeconomic impact, delivering much needed homes.”

Mathieu Elshout, Senior Director Private Real Estate at PGGM, commented: “As a responsible investor of Dutch pension capital, it is our ambition to build long-term partnerships with prominent UK real estate players to invest in LGIM REAL ASSETS 2 sustainable developments. Our growing BTR venture with Legal & General is delivering on this goal, adding quality stock within key regeneration hotspots across the UK. With Glasgow continuing to suffer from a severe lack of homes, we are delighted to be partnering with Legal & General to enter the Scottish market, investing in a high quality scheme which will have a positive impact on the built environment over the long term.”

Buchanan Wharf will bring Legal & General’s Build to Rent portfolio to 3,700 homes across the UK, with a further 6,000 in planning, development or operation anticipated by the end of 2019.